An amendment concerning the same was announced in Budget 2020 which stated that if an employers total contribution to the EPF NPS and superannuation fund exceeds Rs. The new rates will apply throughout 2021 affecting wages for the months of January 2021 February 2021s contribution up to December 2021 January 2022s.

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Overview Given the economic situation due to the pandemic in 20202021 it was announced at Budget 2021 that.

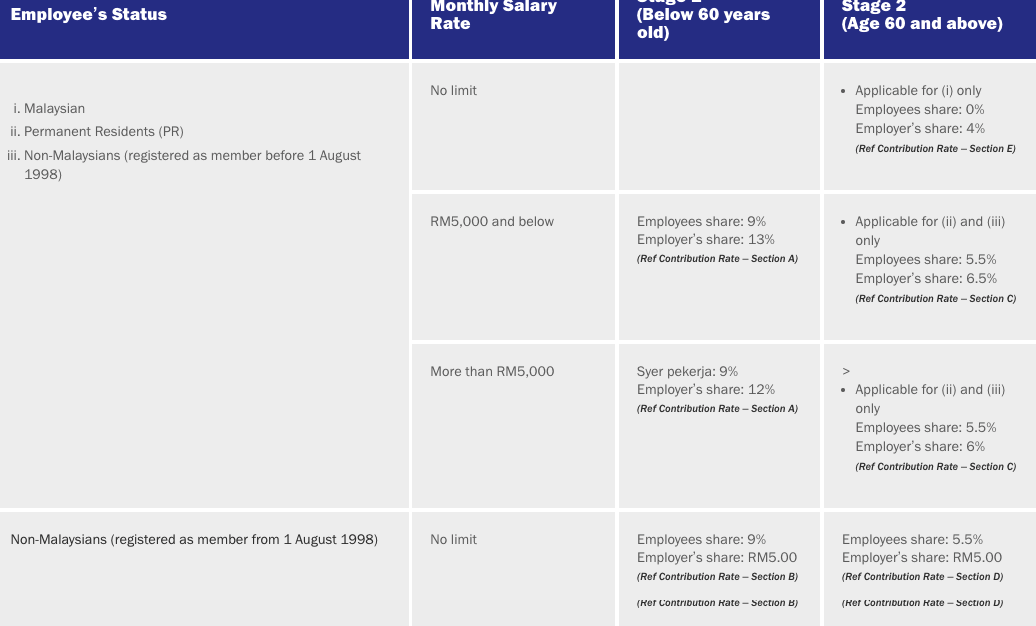

. For Non-Malaysians registered as. Get Help Designing Your Plan. On 30 June 2022 the Employees Provident Fund EPF announced that the employees contribution rate below 60 years old is now 11 effective from July 2022 s salary.

Ad Help Employees Get More Out of Retirement. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Employer contributes 12 of the employees salary.

Discover Which Retirement Options Align with Your Financial Needs. Build Your Future With a Firm that has 85 Years of Retirement Experience. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

Monthly salary greater than RM5000. The standard practice for EPF contribution by employer and employee are. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to.

Build Your Future With a Firm that has 85 Years of Retirement Experience. The employee employer or both can choose to contribute more than the set rate. Contributing More Than The Statutory Rate.

The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty. Since the mandate by the Government of. 1 day agoUnder the Employees Provident Funds and Miscellaneous Provision Act 1952 an employee makes a mandatory contribution at the rate of 12 to their EPF account and the.

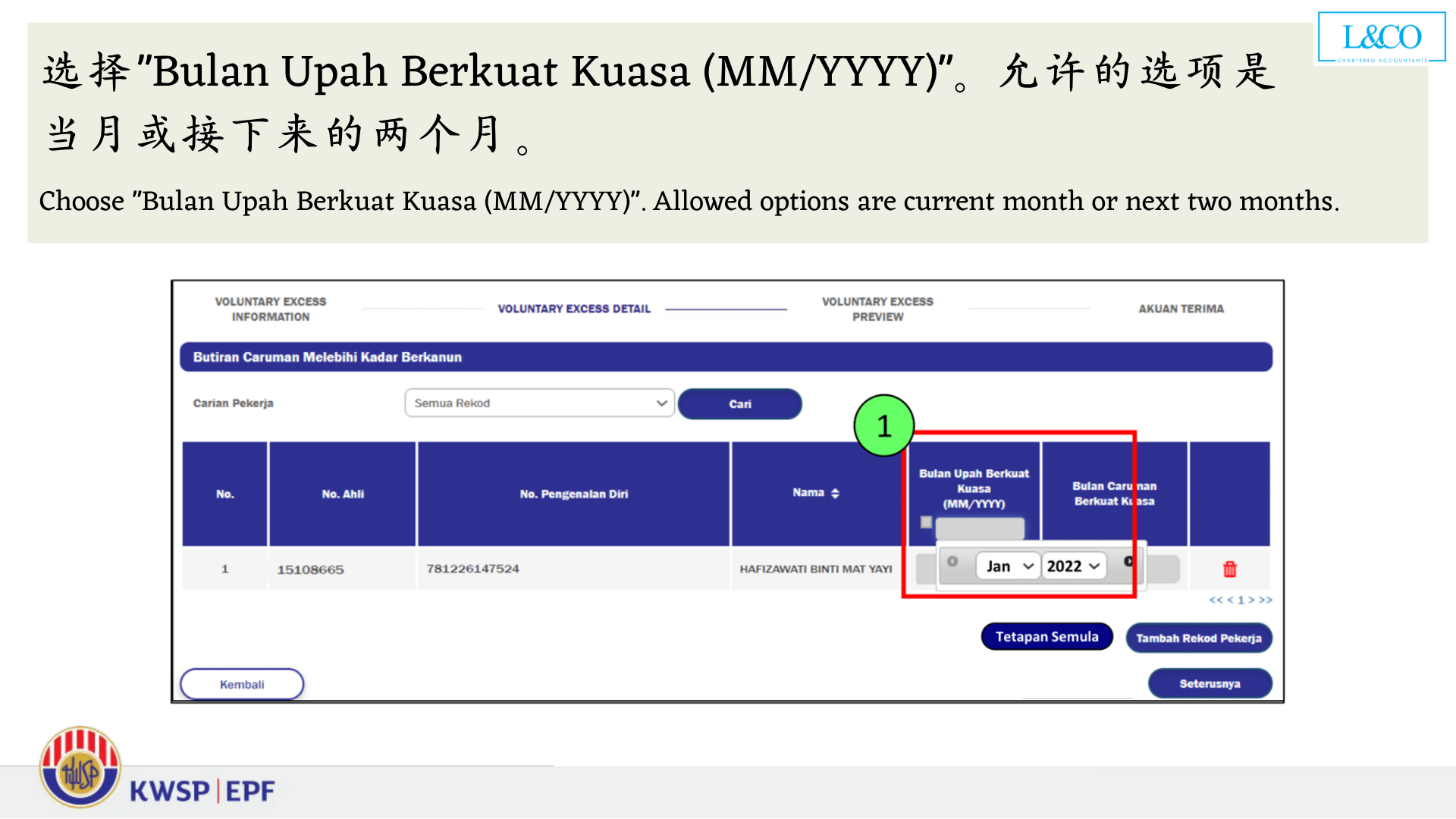

If you want to contribute more for the employee share only employers are required to submit KWSP 17A. To pay contribution on higher wages a joint request from Employee. Learn About Contribution Limits.

Employers Contribution towards EPF. Learn About Contribution Limits. Rate of contribution for Employees Social Security Act 1969 Act 4 No Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme.

As a salaried employee you have the choice of contributing more for better savings. During this period your employers EPF contribution will remain 12. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

The new rates will be in effect for an entire year affecting wages for the months of January 2021 February 2021s contribution up to December 2021 January 2022s. If you want a one-click solution to your HR payroll needs contact us today. Ad Discover The Traditional IRA That May Be Right For You.

Ad Discover The Traditional IRA That May Be Right For You. The maximum salary cap of Rs15000 is not applicable for Non-Resident employees. Employee contributes 9 of their monthly salary.

For sick units or establishments with less than 20 employees the rate is 10 as per Employees. RATE OF MONTHLY CONTRIBUTIONS PART A 1. Ad Find Out What You Need to Know about IRAs and Which is Right for You.

I-Akaun Activation First Time Login. Welcome to i-Akaun Employer i-Akaun Employer USER ID.

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

Pf Contribution Rate From Salary Explained

20 Kwsp 7 Contribution Rate Png Kwspblogs

20 Kwsp 7 Contribution Rate Png Kwspblogs

Confluence Mobile Support Wiki

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Epf Contribution Rates 1952 2009 Download Table

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Sql Account Estream Hq Employee Epf Contribution Rate From 11 Reduced To 7 Effective From 1 April 2020 To 31 December 2020 Employer Epf Current Contribution Rate Not Change To

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

New Statutory Contribution Rate Of 2021 9 Or 11

Epf Change Of Contribution Table Ideal Count Solution Facebook

Why Did The Government Implement A Cut In The Epf Contribution To 10 Quora

Steps To Apply Employee S Epf Contribution Rate At 11

Epf Contribution Rates 1952 2009 Download Table

Confluence Mobile Support Wiki